NEWSLETTER

02/2025

Credible greenhouse gas reporting is a must have

Transition towards net-zero in the cement sector requires transparent information on CO₂ emissions for the value chain of building products and CCUS accounting

The reporting of greenhouse gas (GHG) emissions in the cement sector asks for consistent and transparent monitoring procedures. This is especially relevant for the accounting in emission trading schemes like the EU ETS. Precise data is needed to assess emission reductions achieved by the use of new technologies and investments for increased efficiency in the clinker and cement production process. Furthermore, the EU ETS as well as product specific CO2 footprints ask for verified or certified information, in order to claim economic benefits from saving emission allowances and revenues in lead markets for low carbon products. As new technologies are applied in the cement industry, also the methodologies for GHG monitoring and reporting evolve and have to enlarge their scope and detail along the relevant value chains (figure 1).

Figure 1: Greenhouse gas monitoring and reporting in the cement industry

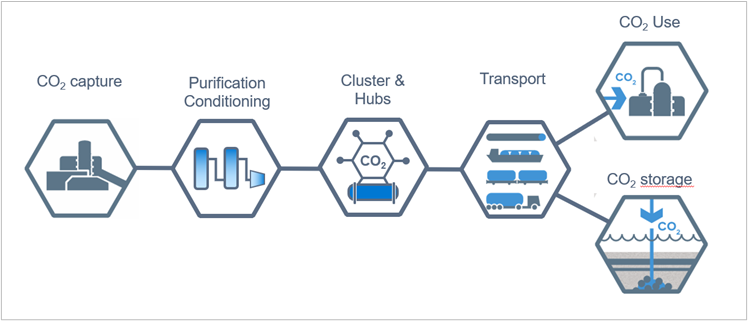

In the cement industry different reporting systems are used in parallel. External and company internal reporting systems may be already established and harmonised as far as possible. Still, in the light of the application of CO2 capture technologies new questions are to be solved regarding the CO2 accounting along the CCUS value chain (figure 2).

The EU has started to develop corresponding legislation, updating the EU ETS Monitoring and Reporting Regulation (MRR), Renewable Energy Directive, definition of synthetic renewable and recycled fuels (RFNBO, RCF), etc., with some risk of inconsistency between accounting approaches.

Figure 2: CCUS value chain (Source: VDZ)

New tasks for monitoring in ETS especially regarding CCUS

The EU ETS is expected to see significant rise in CO₂ prices in the next decade, when climate neutrality in Europe’s industries is prescribed by a net zero emission cap towards 2040. Thus, the EU ETS together with dedicated funding schemes are required to provide a significant price signal and to de-risk investments in large-scale decarbonisation projects, infrastructures and the operation of new technologies (CAPEX and OPEX). The precise assessment of CO₂ emission savings is then fundamental in order to claim revenues for increased operational costs and for allowing technology use at industrial scale. This applies to new technologies like CO₂ capture, storage (CCS) and use (CCU), production of new cements and calcined clay. But it also applies to the savings by use of sustainable biomass derived from waste materials and their potential CCS accounting as negative emission. Today, the MRR fails to provide clarity on the accounting of negative emissions technologies (NET) under the EU ETS and, in its latest revision, has introduced accounting rules for captured CO₂ that make it difficult to calculate a robust business case. New draft legislation is only expected in 2026. Before, first projects are now facing many challenges when preparing investment decisions for the early start and deployment of CO₂ capture. Whether the current development of a voluntary carbon removals market in the EU can help in the short term to secure potential revenues from negative emissions remains to be seen. Only for the CO₂ transport and storage in the new CCS value chain it is clear that both activities are already included in the EU ETS. This means an obligation to quantify and report any loss of CO₂. New measurements of the concentrated CO₂ mass flow have to be applied. They will indicate the effectiveness and responsibility of each element in the CCS value chain based on the inputs and outputs. Finally, the proof of the precise overall GHG emission saving will impact the economic efficiency of CCS.

Reporting of CO₂ in products

The introduction of new breakthrough technologies requires developing effective Carbon Leakage protection. The EU started a carbon border adjustment mechanism (EU CBAM) with an initial reporting phase since 2024. From 2026 onwards importers of so called CBAM products like clinker and cement will have to monitor and in 2028 also verify the specific CO₂ footprint of imported products. This becomes particularly relevant with a view to the phase-out of free allowance for CBAM sectors like cement by 2034. The new link between reporting direct emission in the EU ETS compliance market with the EU CBAM for imported products makes it necessary to define a comparable scope, integrating potential product precursor materials when they are related to relevant CO₂ emissions and indirect emissions from grid electricity. Next, consistent precision and verification in the EU CBAM still have to be established.

Product specific reporting on CO₂ is already performed for environmental product declarations (EPDs). The question arises to what extent it should be possible to translate decarbonisation efforts in cement plants into reductions in the CO₂ footprint of clinker, cement or concrete on the basis of mass balancing. Different concepts are currently being discussed in the standardisation of life cycle assessments (LCA), but their future applicability remains uncertain.

Tools for reporting company and international roadmap progress

The cement industry has a historic record of establishing efficient tools for monitoring and reporting GHG emission data. Already 1999 the Cement CO₂ and Energy Protocol has been developed initially in the Cement Sustainability Initiative. Now it is in hands of the Global Cement and Concrete Association (GCCA). A task group is currently developing it to a new version 4, which will incorporate tools for accounting for new processes like calcination of clay, CCS and CCU. The earlier version 3.1 was the basis for successful verification tests in two cement plants in Europe and the development of the EN 19694-3 standard. Subsequently the ISO 19694-3 standard was elaborated. These tools provide a solid basis for GHG reporting in the cement sector. Still, the fast introduction of new technologies, the extension of scopes and new uses of precise CO₂ data for product CO₂ footprints and labels, require further development of the accounting methodologies.

The sector clearly envisages the aim of deep decarbonisation and it is necessary to monitor the progress on the path towards net zero targets. The need remains to provide credible answers and to allow for assessment of climate performance and targeted preferences for low carbon products. Precise and transparent information on CO₂ emissions at all levels of the relevant value chains will therefore be a key element of the ongoing transition in the cement industry.